Pro Business Valuation & Equipment Appraisal offers technical field examinations, inspections, asset verifications for SBA and asset based lending for due diligence, contractual monitoring, special assets and loan workouts. We provide both eyes on-site and the technical expertise that are needed to deliver a reliable understanding of collateralized and special assets for distant lenders and stakeholde

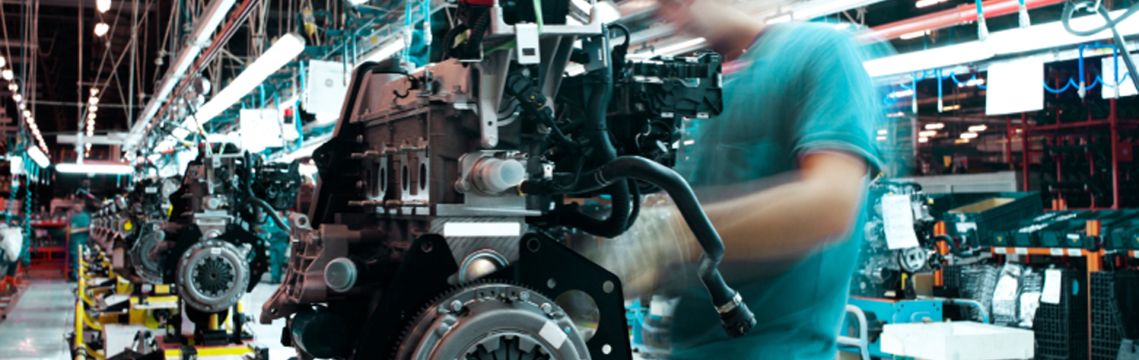

Field examinations, also known as field audits or collateral audits, are a comprehensive assessment and verification process conducted by financial institutions or lenders to assess the financial condition, collateral, and risk associated with a borrower or a specific loan. Field examinations are typically performed for businesses that have significant assets, such as manufacturing companies, distributors, or businesses in the construction industry.

During a field examination, a team of auditors or examiners visits the borrower’s premises to gather information, review documentation, and physically inspect the assets. The purpose of the examination is to validate the accuracy of financial statements, assess the condition and value of collateral, evaluate the business’s operations, and identify any potential risks or concerns.

Key aspects covered in a field examination may include:

Financial Statement Analysis: The examiners review the borrower’s financial statements, including the balance sheet, income statement, and cash flow statement, to assess the company’s financial health and performance.

Collateral Evaluation: Physical inspection and valuation of collateral assets pledged as security for the loan are conducted. This may include inventory, equipment, real estate, accounts receivable, and other relevant assets.

Documentation Review: The examiners analyze key legal and financial documents, such as loan agreements, contracts, leases, insurance policies, and vendor agreements, to ensure compliance and identify potential risks.

Operational Assessment: The business’s operations and internal controls are evaluated, including the review of management practices, organizational structure, inventory management, quality control processes, and production capabilities.

Risk Identification: The field examination aims to identify any potential risks or red flags that may impact the borrower’s ability to repay the loan. This includes assessing market conditions, industry trends, competition, regulatory compliance, and other external factors.

Compliance Verification: The examination verifies the borrower’s compliance with loan covenants, including debt service coverage ratios, financial reporting requirements, and other contractual obligations.

Report and Recommendations: After completing the field examination, the examiners prepare a detailed report highlighting their findings, including any concerns, risks, or areas of improvement. Recommendations may be provided to mitigate risks and improve the borrower’s financial position.

Field examinations provide lenders with a comprehensive understanding of the borrower’s financial condition, collateral value, operational strengths, and potential risks. The information gathered during the examination helps lenders make informed decisions regarding loan terms, monitoring, and risk management.

Pro Business Valuations, LLC provides Lawyers, Lenders, CPAs and Business Owners with USPAP compliant, SBA qualified, appraiser certified business and industrial equipment appraisals and consulting.